Page 17 - VGEylul_2018

P. 17

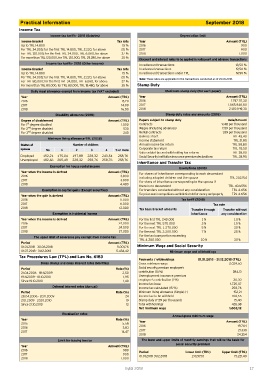

Practical Information September 2018

Income Tax

Income tax tariffs- 2018 (Salaries) Depreciation limit

Income bracket Tax rate Year Amount (TRL)

Up to TRL 14.800 15 % 2016 900

For TRL 34.000; for the first TRL 14.800, TRL 2.220, for above 20 % 2017 900

For TRL 120.000; for the first TRL 34.000, TRL 6.060, for above 27 % 2018 1.000

For more than TRL 120.000, for TRL 120.000, TRL 29.280, for above 35 % Discount and interest rates to be applied in rediscount and advance transactions

Income tax tariffs- 2018 (Other income) In rediscount transactions 18,50 %

Income bracket Tax rate In advance transactions 19,50 %

Up to TRL 14.800 15 % In rediscount transactions under TPL 19,50 %

For TRL 34.000; for the first TRL 14.800, TRL 2.220, for above 20 % Note: These rates are applicable to the transactions conducted as of 29.06.2018.

For TRL 80.000; for the first TRL 34.000, TRL 6.060, for above 27 %

For more than TRL 80.000, for TRL 80.000, TRL 18.480, for above 35 % Stamp Duty

Daily meal allowance exempt from income tax (VAT excluded) Maximum stamp duty (For each paper)

Year Amount (TRL) Year Amount (TRL)

2016 13,70 2016 1.797.117,30

2017 14,00 2017 1.865.946,80

2018 16,00 2018 2.135.949,30

Disability allowance (2018) Stamp duty rates and amounts (2018)

Degree of disablement Amount (TRL) Papers subject to stamp duty Rate/Amount

st

For 1 degree disabled 1.000 Contracts 9,48 per thousand

For 2 nd degree disabled 530 Wages (Including advances) 7,59 per thousand

rd

For 3 degree disabled 240 Rental contracts 1,89 per thousand

Balance sheet TRL 45,40

Minimum living allowance-TRL (2018)

Income statement TRL 21,80

Status of Number of children Annual income tax return TRL 58,80

spouse No 1 2 3 4 5 or more Corporate tax return TRL 78,50

Value added tax and withholding tax returns TRL 38,80

Employed 152,21 175,04 197,88 228,32 243,54 258,76 Social Security Institution insurance premium declarations TRL 28,90

Unemployed 182,66 205,49 228,32 258,76 258,76 258,76

Inheritance and Transfer Tax

Exemption for house rental income Exemptions (2018)

Year when the income is derived Amount (TRL) For shares of inheritance corresponding to each descendant

2016 3.800 including adopted children and the spouse TRL 202.154

2017 3.900 For share of inheritance corresponding to the spouse if

2018 4.400

there is no descendant TRL 404.556

Exemption in capital gains (Except securities) For transfers conducted without any consideration TRL 4.656

Year when the gain is derived Amount (TRL) For prizes won in competitions and lotteries held for money and property TRL 4.656

2016 11.000 Tax tariff (2018)

2017 11.000 Tax rate

2018 12.000 Tax base bracket amounts Transfer through Transfer without

Exemption in incidental income inheritance any consideration

Year when the income is derived Amount (TRL) For the first TRL 240.000 1 % 10 %

2016 24.000 For the next TRL 570.000 3 % 15 %

2017 24.000 For the next TRL 1.270.000 5 % 20 %

2018 27.000 For the next TRL 2.200.000 7 % 25 %

The upper limit of severance pay exempt from income tax For the tax base portion exceeding

TRL 4.280.000 10 % 30 %

Period Amount (TRL)

01.01.2018 - 30.06.2018 5.001,76 Minimum Wage and Social Security

01.07.2018 - 31.12.2018 5.434,42 Minimum wage and withholdings

Tax Procedures Law (TPL) and Law No. 6183

Payments / withholdings 01.01.2018 - 31.12.2018 (TRL)

Delay charge and delay interest rates (Monthly) Gross minimum wage 2.029,50

Period Rate (%) Social security premium employee’s

21.04.2006 - 18.11.2009 2,50 contribution (14 %) 284,13

19.11.2009 - 18.10.2010 1,95 Unemployment insurance premium

Since 19.10.2010 1,40 employee’s contribution (1 %) 20,30

Income tax base 1.725,07

Deferral interest rates (Annual) Income tax calculated (15 %) 258,76

Period Rate (%) Minimum living allowance (Single) (-) 152,21

28.04.2006 - 20.11.2009 24 Income tax to be withheld 106,55

21.11.2009 - 20.10.2010 19 Stamp duty (7,59 per thousand) 15,40

Since 21.10.2010 12 Total withholdings 426,38

Net minimum wage 1.603,12

Revaluation rates

Annual gross minimum wage

Year Rate (%) Year Amount (TRL)

2015 5,58

2016 3,83 2016 19.764

2017 14,47 2017 21.330

2018 24.354

Limit for issuing invoice The lower and upper limits of monthly earnings that will be the basis for

Year Amount (TRL) social security premium

2016 900 Period Lower limit (TRL) Upper limit (TRL)

2017 900 01.01.2018-31.12.2018 2.029,50 15.221,40

2018 1.000

Eylül 2018 Eylül 2018 17